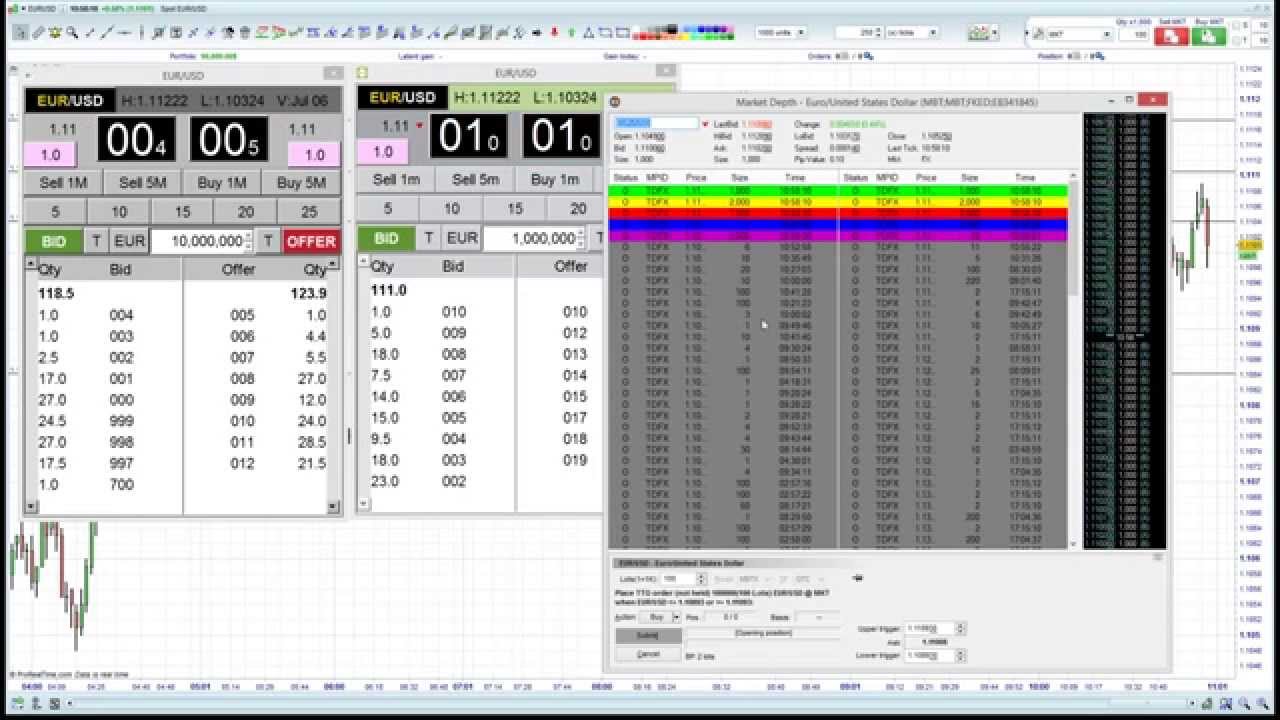

Market Depth: One of the short coming of Meta Trader 4 is that, it cannot show the market depth of the instrument you trade. Checking the market depth and order ladder is very important for most of the traders and hence to remove the inconvenience faced by our traders, we provide you the best five order depth 7/12/ · You can identify the nature of the buying and selling taking place by looking at market depth because in such situations the HFT guys usually turn their systems off due to the high volatility giving market depth readers clearer readings. During the open and around the close of the market 6/21/ · Depth of market or DoM is the MetaTrader 5 tool, which allows the client to see the market liquidity (depth of liquidity) for the financial asset. When a client clicks the right mouse button on the Market Watch symbol, he can choose from the drop-down menu “Depth of market” blogger.comted Reading Time: 6 mins

MARKET DEPTH TOOLS | FOREX trading as it should be

Depth of Market, aka the Order Book, is a window that shows how many open buy and sell orders there are at different prices for a security, depht of forex. The data is streamed from the broker. The data in the DOM and the chart may be slightly different since various data sources are used. By default data is shown in a semi-static format, depht of forex. This means that the price rows are fixed while the price moves within the shown range. The 5-second timer is the middle icon [7].

To place a market order simply click Buy Market or Sell Market. The number shows how many securities will be bought or sold, you specify that at the top of the DOM window [1]. It also syncs with the floating trading panel. You can place depht of forex at a specific prices To buy — click the cell at a price you want in the left column, depht of forex, to sell — in the right one.

If you want to place a limit order, just click in the cell next to the desired price, if you want to place a stop order, hold the CTRL button on your keyboard and click the cell you want.

If you want to turn this off, you can do so in the settings. Click the label with the number next to the DOM — this is your order label. You can then change any settings that you like, and click MODIFY. The limit level of depht of forex orders is duller in color, and the Stop level is more vibrant. If you are in a position on this symbol you either bought or sold someyour position size [13] will be shown as a number at depht of forex top of the DOM.

If you bought in a long position the box will be blue, and if you sold in a short position it will be red. Depht of forex close the position or reverse it, use the Flatten [8] or Reverse buttons at the bottom of the DOM. Launch chart See overview Search ideas Search scripts Search people.

Depth Of Market DOM What is Depth of Market? How do I open DOM? Connect to the account of the broker who supports Level 2 data TradeStation, CQG, AMP, Tradovate, iBroker, HitBTC or Alor.

Click the DOM button on the right toolbar of the chart. DOM for the current security will open. Main parts of a DOM window explained. The fastest way to follow markets Launch Chart.

Forex In Depth Beginners Overview (After You Watch Your Basic Videos)

, time: 1:13:32Depth Of Market (DOM) — TradingView

10/16/ · Depth of Market is often referred to as the order book, due to the fact Depth of Market data shows the current pending orders for a currency or security. Depth of Market data is usually available from exchange for a fixed fee; however those trading Forex may be able to make use of Tier II Depth of Market data straight from their blogger.comted Reading Time: 3 mins Depth of market (DOM) is an indicator of the current interest in a stock or other asset. It can be read as a signal of the likely direction of a stock's price. It is used to judge the optimal time Depth of market is used by Forex traders in order to help them determine the best levels to enter or exit a position. Many traders utilize the depth of market data in order to make a profit by buying and selling securities or currencies at key levels where there is a cluster of orders and then hold it for a very short time before selling it for a small profit

No comments:

Post a Comment