Practical Elliott Wave Trading Strategies. While you can use many different strategies to find and manage your trades with Elliott wave, the simplest is to follow the patterns. Step #1: Look For the First Three Moves. The first step to this Elliott wave trading strategy is to wait until the price has formed the first three legs of the motive phase Elliott Wave Principle, by A.J. Frost and Robert Prechter. Applying the Wave Principle The practical goal of any analytical method is to identify market lows suitable for buying (or covering shorts), and market highs suitable for selling (or selling short). The Elliott Wave Free Elliott Wave PDF The free Elliott Wave PDF by Kenny at Traders Day Trading is our quick start guide that will give you a very good overview of the basics of the Wave theory. The PDF gathers together much of the information on EW that is published on this site into a handy PDF reference guide which is free to download

Practical Elliott Wave Patterns Trading Strategies With Free PDF

edu no longer supports Internet Explorer. To browse Academia. edu elliott wave theory forex pdf the wider internet faster and more securely, elliott wave theory forex pdf, please take a few seconds to upgrade your browser. Log In with Elliott wave theory forex pdf Log In with Google Sign Up with Apple. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF, elliott wave theory forex pdf.

The Application of Fibonacci Sequence and Elliot Wave Theory in Predicting Security Price Movements: A Survey. Amitava Chatterjee, elliott wave theory forex pdf. Felix Ayadi. Download PDF Download Full PDF Package This paper.

A short summary of this paper. edu O. Felix Ayadi, Ph. Department of Managerial Economics and Finance School of Business and Economics Fayetteville State University Murchison Road Fayetteville, NC fayadi uncfsu. An earlier version of the paper was presented at the Academy of Economics and Finance Annual Conference.

Amitava Chatterjee is Associate Professor of Finance at Fayetteville State University, USA. He received his Ph. in Finance from The University of Mississippi. His research interests are in international finance, derivative securities, real estate, and market efficiency. His research has been published in Journal of Real Estate Finance and Economics, International Journal of Finance, International Review of Financial Analysis, Journal of Emerging Markets, OPEC Review, Journal of Global Business, Managerial Finance and many other journals.

Felix Ayadi is Professor of Finance at Fayetteville State University, USA. He received the doctorate degree in Finance from The University of Mississippi. His published work has appeared in Journal of Banking and Finance, Global Finance Journal, Financial Services Review, Journal of Multinational Financial Management, International Review of Financial Analysis, OPEC Review, Managerial Finance and many other journals.

Acknowledgment: Authors wish to thank Everett V. Davis Jr. for excellent research assistance. The study further describes the details of the Elliott Wavelet theory to describe the rhythmic regularity which has been observed in the U. stock market over an eighty year period as an application of Fibonacci series. Applications of Fibonacci sequence and the Wavelet theory in the equity market are described to supplement the validity of the argument. Key Words: Fibonacci Sequence, Elliott Wavelet Theory, Golden Ratio, Impulse and Corrective Waves.

The sequence is 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, etc. The farther along the sequence, the closer the decimal equivalent of the ratio of two successive numbers in the sequence nears 1. Similarly, elliott wave theory forex pdf, the ratio of alternate numbers of the sequence approaches 2. According to Erman [3], this ratio can be seen throughout nature and is typified by the arrangement of seeds in a sunflower or the shape in a Chambered Nautilus.

The sequence is also found extensively in music and in architecture. The sequence and the ratio are also being used to predict the stock market swings or oscillations and price targets.

Fischer [6], Hartle [9], and Krausz [10], however, concluded against the stand alone use of the sequence. The best use of the sequence is to predict future irregular cyclic moves in a stock which are elliott wave theory forex pdf on past moves. Fibonacci numbers can be applied to progressions of price support and resistance levels by using an initial price as the first number of a Fibonacci series and then predicting the recurrence of another price support or resistence level.

The next Fibonacci number in the series is a predictor of a successor in the series. Eng [2] and Plummer [13], [14] provided the outline for successfully using of the sequence. Next on a pricing chart, the prices are tracked until the first interval has been identified. The first identifiable interval is the first term of the Fibonacci sequence. Traders then can draw a new prediction line equal to the length of the first interval to identify the next interval in the sequence.

This process can be continued for as many iterations as are desired. Once Fibonacci lines are established, the professional trader will use other techniques to confirm their predictions before taking a position. Eng [2] considered that Fibonacci cycles are especially helpful when the markets are irregular and cycles are hidden in the fluctuating activity. In this situation, it is best not to force a fit to the current market activity, but to go back in time to when the market was more predictable and use that time as the starting point.

Using the technique of applying the sequence from a stable condition will aid subsequent iterations in the predicting process. The object is to find the most obvious points since they will have the best chance of providing an accurate prediction basis.

The idea runs contrary to the market efficiency argument put forward by numerous researchers. As in music, art, elliott wave theory forex pdf, architecture, and nature, the Fibonacci sequence is a numerical abstraction of a pattern of events which depends upon previous events for the future development of the sequence.

The next section describes the underlying principles and the use of Fibonacci series in predicting future price movements. The following section provides details of Elliott Wavelet theory to describe the rhythmic regularity as obtained from a Fibonacci series of the past stock price movements.

Section four details some applications of Fibonacci sequence and Wavelet theory on the equity market. The last section concludes the discussion. The natural limit produces the Golden Ratio. The Golden Ratio is applicable to any ratio generated from a series as the numbers in the series increase. As a variation of the Golden Ratio, the natural limit of the ratio of two alternate numbers approaches 2, elliott wave theory forex pdf.

An example of the approximation of the Golden ratio the ratio of two successive numbers and its inverse through Fibonacci sequence is provided in Table 1. Table 1 here Tribonacci Summation Series: To compliment the analysis of Fibonacci sequence, Prechter and Frost [16] described the principles of Tribonacci series. As a variation of the Fibonacci sequence, the series uses the sequence 0, 1, 1, 2, 4, 7, 13, 24, 44, 81, etc.

As the sequence grows, the ratio of two successive numbers in the series approaches 0. Analysis of the markets has shown that the retracements of rallies also approach this ratio in sequencing numbers. Balan [1], Gately [8], and Murphy [12] reported various financial markets applications of the Fibonacci sequence.

The Fibonacci sequence can be used to predict the occurrences in the financial markets but should not be treated as a stand-alone predictor.

The markets can send a multitude of signals and there is no one indicator that is infallible in detecting the support and reversal points. A learning curve elliott wave theory forex pdf the trader can be established as one traces the trends by applying the ratios to either a major market top or bottom the first day and then projecting into the future in the second day 2the third day 3the fifth day 5the eighth day 8the thirteenth day 13 elliott wave theory forex pdf, and so forth in the sequence.

One can expect from this exercise, with a degree of certainty, to see a reversal in the price action on one of these Fibonacci predicted significant days. On the downward movements of the markets, the application of the Fibonacci numbers can be used to trace retracement moves. Thus, retracements the bear moves will demonstrate the ratio of 0. Eng [2] pointed out that Fibonacci cycles work well in markets which seem to have loosely defined but with seemingly unpredictable cyclicity.

Fibonacci cycles give useless signals in markets with over-pronounced and very regular cyclicity. They also do not work well in very short-cycle markets, as they need time to build up a train of intervals. Fibonacci cycles are an especially good idea to use with pattern recognition methods, elliott wave theory forex pdf, since they attempt to make the kind of predictions which Fibonacci cycles can confirm. Krausz [10] pointed out that Fibonacci cycles also have much in common with the Gann Anniversary dates the procedure is described in detail in [4] and [5] and can be used profitably as confirmation tools as well.

Fibonacci cycles do not work quite as well with methods which rely less on global pattern recognition of price moves, such as point-and-figure, volume-based techniques, or methods which work more with the local breakout rather than tops and bottoms, such as moving averages or oscillators. Elliott in a series of articles in The Financial World in The basis of the Elliott Wave Theory has been developed from the observation that rhythmic regularity has been observed in the stock market over an eighty year period.

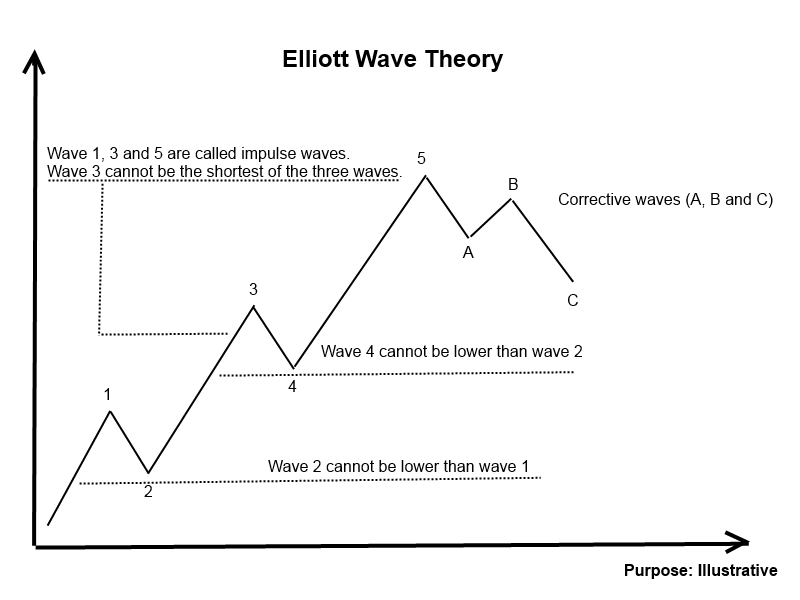

It has been further observed that the market moved forward in a series of five 5 waves and declined in a series of three 3 waves a Fibonacci sequence. The longest cycle in the Elliott Wave Theory is called the Grand Super-cycle. In turn, each Grand Super-cycle can be subdivided into eight Super-cycles five Impulse and three Corrective waveseach is then divided into eight cycles or waves.

This process continues to embrace Primary, Intermediate, elliott wave theory forex pdf, Hourly, Minute, and sub-Minute waves. They observed that the theory interprets market actions in terms of recurrent price structures. Basically, market cycles are composed of two major types of Waves: Impulse Wave denoted by numbers and Corrective Wave denoted by letters.

For every impulse wave, the structure can be sub-divided into five waveswhile for corrective wave, the structure is sub-divided into three waves A-B-C. An impulse wave moves in the same direction as the trend of the next larger size, while a corrective wave moves against the trend of the next larger size.

In the next stage, the basic patterns of five- and three-wave structures link to form an increasingly larger size next level of five- and three-wave structures. An important feature of Elliott Wave is that they are fractal in nature.

This implies that the market structure is built from similar patterns on a larger or smaller scale. Therefore, the waves can be counted on a long-term elliott wave theory forex pdf market chart as well as short-term hourly market chart.

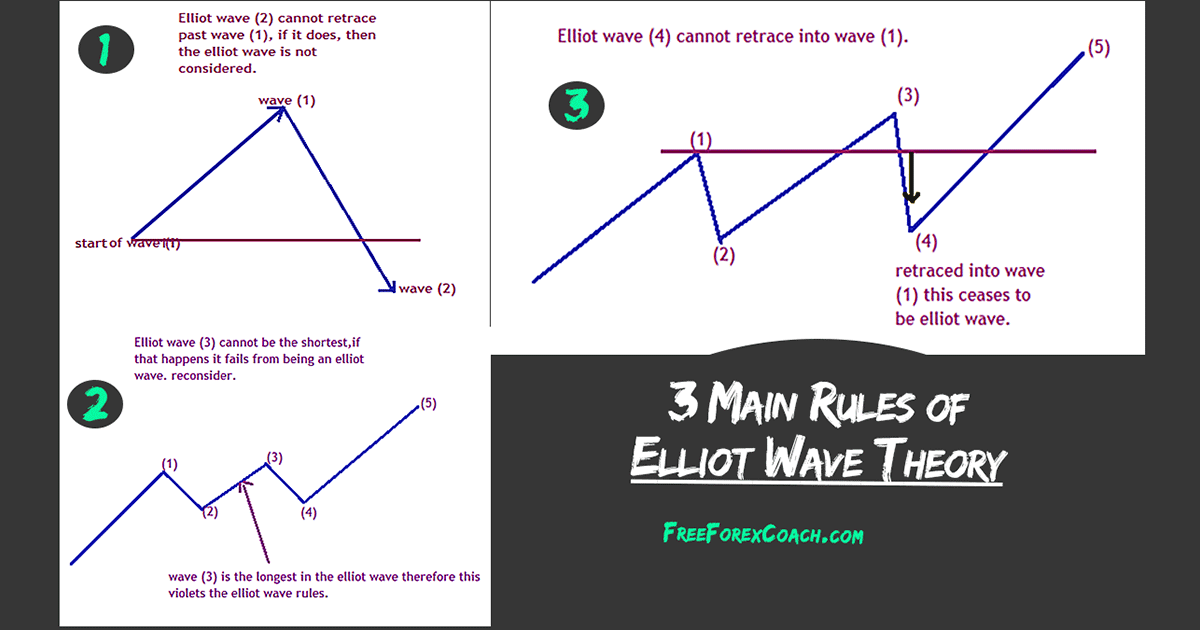

Figure 1 describes the impulse and corrective wave patterns of various size classes. As the market pattern is interpreted as relatively simplistic, there are several rules for valid counts, elliott wave theory forex pdf.

a Wave 2 should not break below the beginning of Wave 1; b Wave 3 should elliott wave theory forex pdf be the shortest wave among Waves 1, 3, and 5. c Wave 4 should not overlap with Wave 1, elliott wave theory forex pdf, except for Waves 1, 5, elliott wave theory forex pdf, A, or C of a higher degree. d Rule of Alteration: Waves 2 and 4 should unfold in two different wave forms.

Elliott Wave Theory SIMPLIFIED! Actual Practical Steps You Can Start Applying in Forex Trading Today

, time: 11:47Using Elliott Wave Theory To Trade Forex

Practical Elliott Wave Trading Strategies. While you can use many different strategies to find and manage your trades with Elliott wave, the simplest is to follow the patterns. Step #1: Look For the First Three Moves. The first step to this Elliott wave trading strategy is to wait until the price has formed the first three legs of the motive phase Free Elliott Wave PDF The free Elliott Wave PDF by Kenny at Traders Day Trading is our quick start guide that will give you a very good overview of the basics of the Wave theory. The PDF gathers together much of the information on EW that is published on this site into a handy PDF reference guide which is free to download If you would like to purchase the textbook, Elliott Wave Principle - Key to Market Behavior, which explains the wave theory in great detail, please contact one of our sales representatives at (inside the U.S.) or + (outside the U.S.)

No comments:

Post a Comment