If you had a loss on your Section trades, the IRS will allow you to carry back the loss up to two years; TurboTax will assist you with applying the carry-back to amended returns, which may Also, if your forex account is huge and you lose more than $2 million in any single tax year, you may qualify to file a Form If your broker is based in the United States, you will receive a at the end of the year reporting your total gains/losses Oct 16, · For tax purposes, every Section gain or loss is treated as being 60% long term and 40% short term, no matter how long you own it. Long-term gains, defined as those held for longer than one year, generally have more advantageous tax characteristics than short-term gains, which are held for one year or less. Using Form

How to Report FOREX Losses | Finance - Zacks

Why Zacks? Learn to Be a Better Investor. Keep Me Signed In Forex loss tax return does "Remember Me" do? Forgot Password. With forex loss tax return right software at hand, forex traders can mostly dispense with the paperwork.

If you've made money trading foreign currencies, then the IRS wants to know about it, forex loss tax return. TurboTax and other tax-preparation software make it fairly easy to track and report your gains, and your trading platform should provide the backup documentation, if needed.

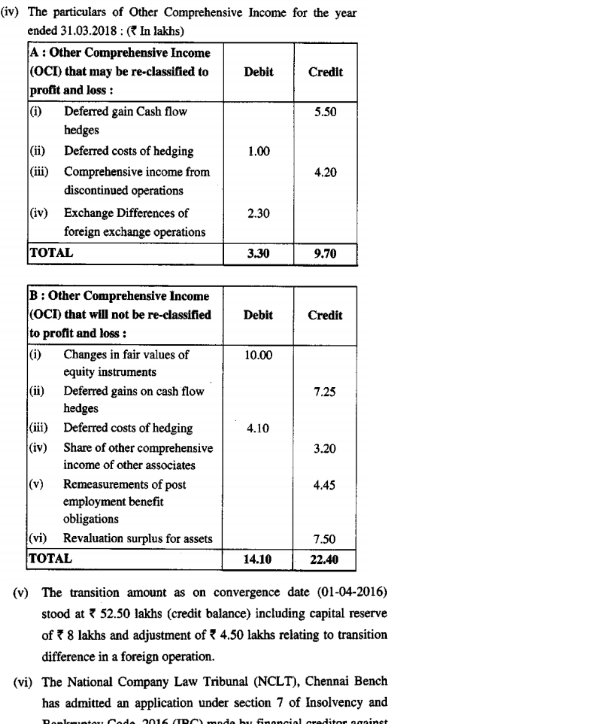

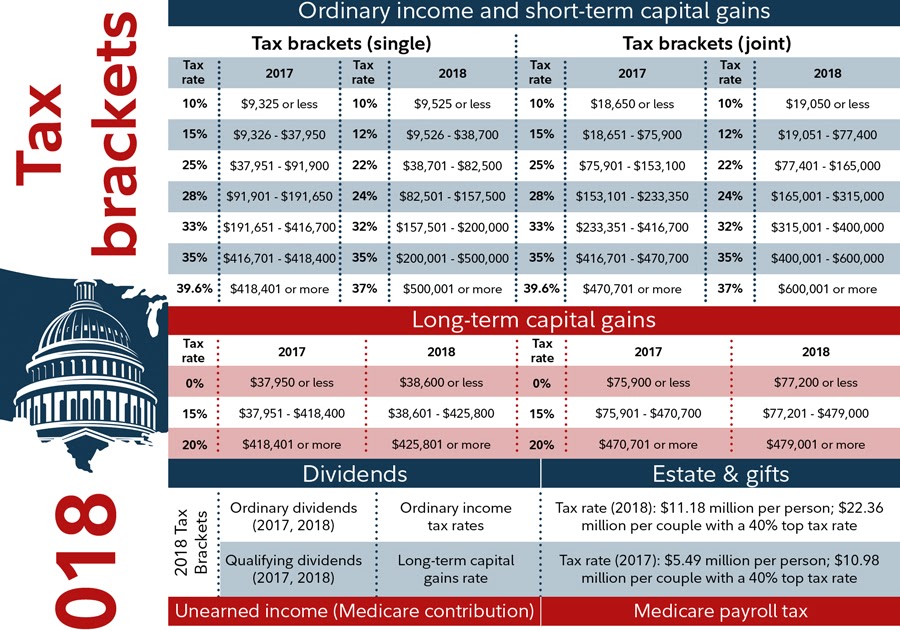

Keep in forex loss tax return the important choice you have to make, as a forex trader, to treat forex gains as miscellaneous or investment income. As a forex trader, you have a choice of two very different tax treatments: Section or Section With the latter, you report gains on Form and can split your gains: 60 percent at the long-term rate 15 percent as of forex loss tax return 40 percent at the short-term rate your own marginal income tax rate -- no matter how long you held your position.

Under Sectionyou report gains and losses as interest income or loss, with any gain added to your ordinary income from other sources. You can opt out of Section and select the Section treatment, forex loss tax return, but you must do so before you start currency trading. With the free online version, you can only file a basic EZ return; the Deluxe version does not handle gains and losses from investments or forex trading.

All TurboTax versions are available via the company's website for download; your broker may allow you to import your trade data directly into the program once you have it installed on your computer. If you've elected to report forex trading under Sectionthen you can import the data from your broker directly into TurboTax forex loss tax return a program such as GainsKeeper. Forex loss tax return, you can enter the information manually into TurboTax as Miscellaneous Income.

The software will ask you to input all income, including ordinary wages, interest, dividends and money earned under the category of "Less Common Income. With Section treatment, you will receive a B from your broker detailing the net profit or loss during the year; your broker may allow this information to be directly imported into the TurboTax program.

If you had a loss on your Section trades, the IRS will allow you to carry back the loss up to two years; TurboTax will assist you with applying the carry-back to amended returns, which may allow you a refund from the IRS. Holding a bachelor's degree from Yale, Streissguth has published more than works of history, biography, current affairs and geography for young readers.

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm, forex loss tax return. Visit performance for information about the performance numbers displayed above.

Member Sign In Keep Me Signed In What does "Remember Me" do? Forgot Password Create a New Account Close this window. Finance Menu Insurance Investing Money Managing Real Estate Retirement Planning Tax Information. More Articles 1. What Does "Long Term Capital Loss" forex loss tax return Schedule D Mean?

How to File the Sale of Vacant Land With the IRS 3. How to File Profits Generated Through Forex Trading. Section Election As a forex trader, you have a choice of two very different tax treatments: Section or Section Importing the Data If you've elected to report forex trading under Sectionthen you can import the data from your broker directly into TurboTax with a program such as GainsKeeper.

The Section Way With Section treatment, you will receive a B from your broker detailing the net profit or loss during the year; your broker may allow this information to be directly imported into the TurboTax program.

References TradersLog: Tax Strategies for Forex Traders Intuit. com: Find the Right TurboTax Product RW Baird: TurboTax® Frequently Asked Questions. gov: Publication Sales and Trades of Investment Property. Related Articles. Quick Links Services Account Types Premium Services Zacks Rank Research Personal Finance Commentary Education. Resources Help About Zacks Disclosure Privacy Policy Performance Site Map. Client Support Contact Us Share Feedback Media Careers Affiliate Advertise.

Follow Us Facebook Twitter Linkedin RSS You Tube. Zacks Research is Reported On: Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors. com, and Morningstar. Logo BBB Better Business Bureau. Copyright © Zacks Investment Research At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed, forex loss tax return.

How To Paying Tax On Forex Income

, time: 8:51Disclosure of Loss Reportable Transactions | Internal Revenue Service

Also, if your forex account is huge and you lose more than $2 million in any single tax year, you may qualify to file a Form If your broker is based in the United States, you will receive a at the end of the year reporting your total gains/losses May 31, · This is my first year trading in the forex market and I invested a total amount of $ and I never withdrew any capital and lost ALL my money in the forex market (I have documentation of my trades). My question is can I claim all that under investment losses and get that money back on my tax return? The broker was an off shore broker also what is the best way to go about this? Mar 13, · Aspiring forex traders might want to consider tax implications before getting started. Forex futures and options are contracts and taxed

No comments:

Post a Comment