triggering stops and causing a breakout, only for it to be a false one. Patience for price action is key here. 3- We need the break to take the price at least a few bars and a good number of pips. away (~50 pips on an hourly chart) from the breakout point to make this a true Keep Your $ For Your Missus To Spend ‘Cuz’ This Price Action Trading Course is FREE! Seriously ladies and gentlemen, my trader friends and faithful forextradingstrategies4u fans, there are forex websites selling price action trading courses and guess what? You can be Estimated Reading Time: 9 mins These are trading strategies for beginners as well as more experienced currency traders: Day Trading – Entering and exiting a position within the same day.; Swing Trading – Catching a swing in the market and holding on to that swing until it hits the targeted profit or shows signs of reversal.; Scalping – Entering and exiting a position frequently, profiting from small price movements

Price Action Trading Course (LEARN FOREX PRICE ACTION)

Free forex price action strategies you want to learn about Price Action Tradingthen this forex price action trading course will really help you. I must warn you though that this price action trading course is fairly long and you many need a cup of coffee…but its not boring. If you think its boring and let me know and I will hire a comedian to edit it To give you an idea of the topics that this price action trading course covers, just scroll on the table of contents shown above.

Seriously ladies and gentlemen, my trader friends and faithful forextradingstrategies4u fansthere are forex websites selling price action trading courses and guess what? The question needs to be asked: does my price action trading course cover everything that you free forex price action strategies to know about the price action trading?

In order for me to answer your question, I will have to ask you a question before I can answer your question …. Do you need to know everything about how a car operates from how the engine works, what makes the wheels turn, how it changes gear, how the brakes work etc. before driving it or do you just need to know how to put put your bum in the car seat and drive? So this price action trading course is like that, it just tells you free forex price action strategies you need to know and just have a look at free forex price action strategies table of contents below to see the range of topics that this price action trading course covers.

As you can see it is a fairly comprehensive and detailed price action trading course that gives you everything you need to know about price action trading. To really understand price action means you need to study what happened in the past. Then observe what is happening in the present and then predict where the market will go next. Then what does he do? Well, from studying the past data and seeing what the current weather situation is at the free forex price action strategies and these days, their prediction is more reliable due advanced computer models and weather satellites in space.

If we get the direction wrong, we lose money, free forex price action strategies, we get it right, we make free forex price action strategies. Simple as that. So everything you are going to read here is about trying to get that direction right before you place a trade. This is an example of risk: reward ratio. Now, free forex price action strategies, the next chapter of the price action trading course, you are going to learn what price action is and lots more, free forex price action strategies.

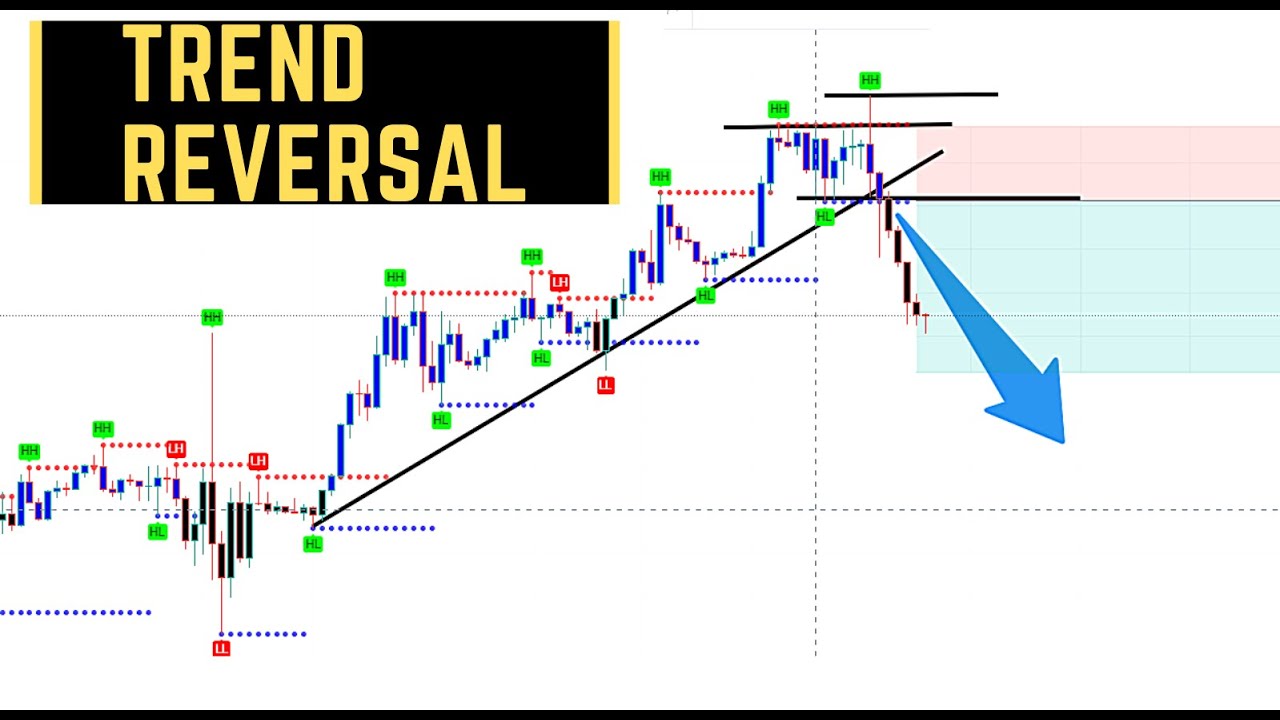

When traders make trading decisions based on repeated price patterns that once formed, they indicate to the trader what direction the market is most likely to move. Price action trading uses tools like charts patterns, candlestick patterns, trendlines, price bands, market swing structure like upswings and downswings, support and resistance levels, consolidations, Fibonacci retracement levels, pivots etc.

Generally, price action traders tend to ignore the fundamental analysis-the underlying factor that moves the markets. Because they believe everything is already discounted for in the market price.

The chart below shows and example of what can happen when there is major forex fundamental news release:. This is one experience I will free forex price action strategies forget.

I traded a perfect price action setup, the trade went as I anticipated but a few minutes later, the market dropped down very quickly. I tried to close that trade as many times as I could but it was impossible to close because the price was way free forex price action strategies below where my stop loss price was!

Price jumped my stop loss. I just stood there and watched helplessly. After what seemed like an eternity, the trade was closed by broker at the worst possible price way-way-way- down below! That single trade nearly wiped out my trading account.

I did not understand and did not know what happened that night to make the market move like that. I could not sleep that night. There are exceptions where I will take a trade if I see that I can place my stop loss behind a major support or resistance level.

One of the best ways to minimize market noise is to trade from larger timeframes instead of trading from smaller timeframes. See the 2 charts below to see what I mean:. And now, compare market noise in the 4hr chart notice the white box on the chart? That equates to the area of the 5min chart above!

Smaller timeframes tend to have too much noise and many traders get lost trading in smaller timeframes because they do not understand that the big trend in the larger timeframe is the one that actually drives what happens in the smaller timeframes.

But having said that, I do trade in smaller timeframes by using trading setups that happen in larger timeframes. I do this to get in at a better price point and keep my stop loss tight. The answer is yes. All the price action trading stuff described here are applicable to all markets. Well, put simply it means you need to trade when the odds are in your favour. Things like:. All these kinds of things above helps you to trade with an edge. You need chart time to understand Price Action. For some of you, it may take a while for you to understand, while some of you may be very quick to learn, free forex price action strategies.

Observe the price action of the market. Go back to the past and see how the market had behaved. What caused it to behave that way? You cannot be a confident price action trader until you do this. If you could simply read the charts well enough to be able to enter at the exact times when the move would take off and not come back, then you would have a huge advantage. All human beings have evolved to respond to certain situations in certain ways. And you can see this happen in the trading world as well:.

The way multitude of traders think and react form patterns… repetitive price patterns that one can see and then predict with a certain degree of accuracy where the market will most likely go once that particular pattern is formed.

You can then say with a greater degree of confidence that Price is going to head down. Because there are so many trader watching that resistance level and they all know that price has been rejected from this level on a previous one or two occasions and that tells them that it is a resistance level and that they can also see that bearish reversal candlestick formation … and guess what they will be waiting to do? Because price action is a representation of mass free forex price action strategies markets are moved by the activities of traders.

So price action trading is about understanding the psychology of the market using those patterns and making a profit as a result. Let me explain…, free forex price action strategies.

No indicators except price action alone. This is when price action trading is used with other indicators and these other indicators form part of the price action trading system. These indicators can be trend indicators like moving averages or oscillators like stochastic indicator and CCI.

Charles Dow is the guy credited to be the father of technical analysis. He came up with the DOW Theory. The theory tries to explain market behavior and focuses on market trends. One part of the theory is that the market price discounts everything. I will cover this a free forex price action strategies bit later when I talk about what are trends, how trends begin or end in Chapter 5 of this price action trading course.

Price is value given to a particular instrument usually in monetary terms and its value is dependent on supply and demand. Every time you open up your charts, free forex price action strategies, all you are seeing are the forces of supply and demand at work! If the market is going up, what does that tell you about the demand and supply then? Or what if the marketing is going down then what does that tell you about the demand and supply then?

So the price of something today will not be the same tomorrow or in a month or in a year. Supply and demand over time drives up and down the price. But how do you represent the value of price over time which in turn tells you of the supply and demand forces? Answer: You need price charts: price bars, candlestick and line charts. These are graphical and visual representation of price over timefree forex price action strategies, thus telling you a story about supply and demand forces over a certain time period which can be 1 minute up to one month or year, free forex price action strategies.

Those green and red thingies are called bars, free forex price action strategies. The green bars are bullish bars which simply means that the closing price is higher then the opening price withing a certain time period. Those red bars are bearish bars and that means that the closing price is lower than the opening price for that period of time.

The knob on the left is the opening price and the knob on the right is the closing price. The highest point or level of the wick on the upper end is the highest price that was reached during a certain timeframe or period and the lowest point of the lower wick is the lowest price that was reached also during the same time frame or period. The chart below is an example of a candlestick chart.

The candlestick chart conveys the same information as in the bar chart above, the only difference is that a candlestick chart has a body and a bar chart has not body. A candlestick chart…to put it in another way is like putting a body over a skeleton of the bar chart! The red colour is most often used to indicate a bearish candlestick which means the price opened up high and closed lower.

A green candlestick represents a bullish candlestick and is the exact opposite. This line chart below is based on the same price information as the bar and candlestick chart shown above.

As you can see, even though, free forex price action strategies, it conveys the same price information over time but does not reveal everything. Out of these 3, the candlestick chart is the most popular followed by the bar chart. So from here on, I will be only focused on candlestick chart only but I may end up using the word bar to refer to candlestick pattern as well so just be aware of that.

I will talk more about the candlestick and candlestick charts as this is the bread and butter for price action traders, free forex price action strategies. Now most traders prefer to set green candlesticks as bullish and red candlesticks as bearish. And I like it to be that way for me personally. All these candlesticks shown below are bullish candlesticks which mean that their opening prices was lower than the closing prices and therefore reflect and overall uptrend in the timeframe each candlestick was formed:.

A bearish candlestick simply means that the candlestick opened up at a high price and closed lower after a certain time period:. All these candlesticks shown below are bearish candlesticks meaning that the opening price was higher than the closing price, therefore reflecting a downtrend:.

My Price Action Trading Strategy [ 2021 ] - Works on ALL Markets! ✅

, time: 13:3612 Price Action Trading Strategies Even Beginners Can Trade

These are trading strategies for beginners as well as more experienced currency traders: Day Trading – Entering and exiting a position within the same day.; Swing Trading – Catching a swing in the market and holding on to that swing until it hits the targeted profit or shows signs of reversal.; Scalping – Entering and exiting a position frequently, profiting from small price movements triggering stops and causing a breakout, only for it to be a false one. Patience for price action is key here. 3- We need the break to take the price at least a few bars and a good number of pips. away (~50 pips on an hourly chart) from the breakout point to make this a true Keep Your $ For Your Missus To Spend ‘Cuz’ This Price Action Trading Course is FREE! Seriously ladies and gentlemen, my trader friends and faithful forextradingstrategies4u fans, there are forex websites selling price action trading courses and guess what? You can be Estimated Reading Time: 9 mins

No comments:

Post a Comment