Oct 30, · CANDLESTICK. Candlesticks were introduced by a Japanese rice trader, Munehisa Homma in 18 th century.; He thought that trader should consider high and low values too along with open and Close values, then he created candlestick in which body and wick of the candle represents high, low, open, close values.; He made fortune by introducing candlesticks and their analysis into his A negative or positive candle formed with a lower shadow that is two thirds or more of the total of the range of the candlestick. The body is on the upper side of the candle. Long Upper Shadow: Bearish signal. Candle with an upper shadow that is two thirds or more of the size of the candlestick Sep 01, · There are three types of candlestick patterns I look for during a trading week. They are the pin bar, engulfing bar and inside bar.. While the pin bar can be traded on the 4-hour and daily time frames, both the engulfing and inside bars are most effective on the daily time frame and blogger.com you use them on any time frame lower than the daily you open yourself up to false blogger.coms: 62

What is a Candlestick, bullish and bearish candles in Forex Trading

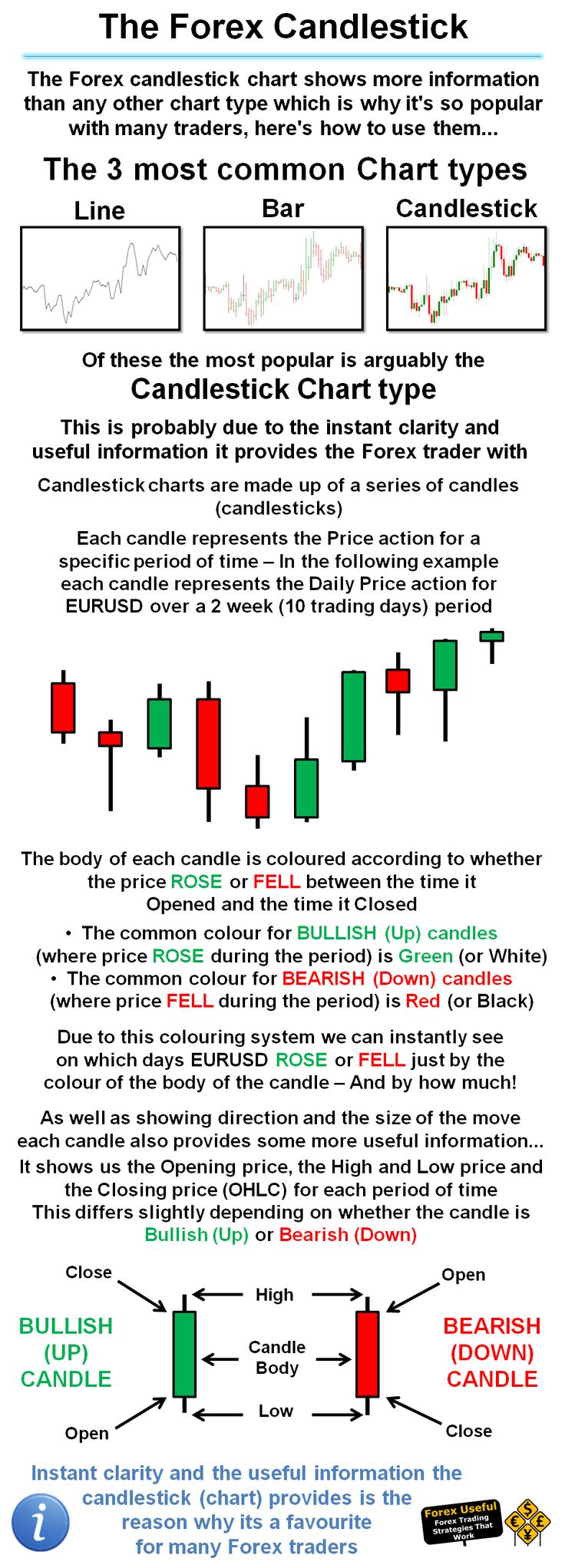

Candlestick charts are a type of financial chart for tracking the movement of securities. They have their origins in the centuries-old Japanese rice trade and have made their way into modern day price charting. Some investors find them more visually appealing than the standard bar charts and the price actions easier to interpret. Candlesticks are so named because the rectangular shape and lines on either end resemble a candle with wicks.

Over time, the candlesticks group into recognizable patterns that investors can use to make buying and selling decisions, whic sign is buy on forex candle sticks. The color of the central rectangle called the real body tells investors whether the opening price or the closing price was higher. A black or filled candlestick means the closing price for the period was less than the opening price; hence, it is bearish and indicates selling pressure.

Meanwhile, a white or hollow candlestick means that the closing price was greater than the opening price. This is bullish and shows buying pressure. The lines at both ends of a candlestick are called shadowsand they show the entire range of price action for the day, from low to high.

Over time, groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiersdark cloud coverhammermorning star, and abandoned babyto name just a few.

Before we delve into individual bullish candlestick patterns, note the following two principles:. The bullish reversal patterns can further be confirmed through other means of traditional technical analysis—like trend lines, momentumoscillatorsor volume indicators—to reaffirm buying pressure.

There are a great many candlestick patterns that indicate an opportunity to buy. We will focus on five bullish candlestick patterns that give the strongest reversal signal. The Hammer is a bullish reversal pattern, which signals that a stock is nearing bottom in a downtrend.

The body of the candle is short with a longer lower shadow which is a sign of sellers driving prices lower during the trading sessiononly to be followed by strong buying pressure to end the whic sign is buy on forex candle sticks on a higher close, whic sign is buy on forex candle sticks.

Before we jump in on the bullish reversal action, however, we must confirm the upward trend whic sign is buy on forex candle sticks watching it closely for the next few days. The reversal must also be validated through the rise in the trading volume. The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support. Again, bullish confirmation is required, and it can come in the form of a long hollow candlestick or a gap up, accompanied by a heavy trading volume.

The Bullish Engulfing pattern is a two-candle reversal pattern. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. On the second day of the pattern, price opens lower than the previous low, yet buying pressure pushes the price up to a higher level than the previous high, culminating in an obvious win for the buyers.

It is advisable to enter a long position when the price moves higher than the high of the second engulfing candle—in other words when the downtrend reversal is confirmed. Similar to the engulfing pattern, the Piercing Line is a two-candle bullish reversal pattern, also occurring in downtrends. The first long black candle is followed by a white candle that opens lower than the previous close.

Soon thereafter, the buying pressure pushes the price up halfway or more preferably two-thirds of the way into the real body of the black candle. As the name indicates, the Morning Star is a sign of hope and a new beginning in a gloomy downtrend, whic sign is buy on forex candle sticks. The pattern consists of three candles: one short-bodied candle called a doji or a spinning top between a preceding long black candle and a succeeding long white one.

The color of the real body of the short candle can be either white or black, and there is no overlap between its body and that of the black whic sign is buy on forex candle sticks before. It shows that whic sign is buy on forex candle sticks selling pressure that was there the day before is now subsiding. The third white candle overlaps with the body of the black candle and shows a renewed buyer pressure and a start of a bullish reversal, especially if confirmed by the higher volume.

This pattern is usually observed after a period of downtrend or in price consolidation. It consists of three long white candles that close progressively higher on each subsequent trading day. Each candle opens higher than the previous open and closes near the high of the day, showing a steady advance of buying pressure. Investors should exercise caution when white candles appear to be too long as that may attract short sellers and push the price of the stock further down, whic sign is buy on forex candle sticks.

The chart below for Enbridge, Inc. ENB shows three of the bullish reversal patterns discussed above: the Inverted Hammer, the Piercing Line, and the Hammer. The chart for Pacific DataVision, Inc.

PDVW shows the Three White Soldiers pattern. Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume, whic sign is buy on forex candle sticks.

Investors should use candlestick charts like any other technical analysis tool i. They provide an extra layer of analysis on top of the fundamental analysis that forms the basis for trading decisions.

We looked at five of whic sign is buy on forex candle sticks more popular candlestick chart patterns that signal buying opportunities.

They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. Such a downtrend reversal can be accompanied by a potential for long gains. That said, the patterns themselves do not guarantee that the trend will reverse. Investors should always confirm reversal by the subsequent price action before whic sign is buy on forex candle sticks a trade.

While there are some ways to predict markets, technical analysis is not always a perfect indication of performance. Either way, to invest you'll need a broker account. You can check out Investopedia's list of the best online stock brokers to get an idea of the top choices in the industry. Technical Analysis Basic Education. Advanced Technical Analysis Concepts. Your Money. Personal Finance.

Your Practice. Popular Courses. Part Of. Options Trading. Futures Trading. Technical Analysis. Technical Analysis Technical Analysis Basic Education. Table of Contents Expand. How to Read a Single Candlestick. Bullish Candlestick Patterns. The Hammer. The Bullish Engulfing. The Piercing Line.

The Morning Star. The Three White Soldiers. Putting it All Together. The Bottom Line. Key Takeaways Candlestick charts are useful for technical day traders to identify patterns and make trading decisions. Bullish candlesticks indicate entry points for long trades, and can help predict when a downtrend is about to turn around to the upside.

Here, we go over several examples of bullish candlestick patterns to look out for. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Technical Analysis Basic Education What Does the Three White Soldiers Pattern Mean? Technical Analysis Basic Education Candlesticks Light The Way To Logical Trading. Technical Analysis Basic Education Tweezers Provide Precision for Trend Traders.

Technical Analysis Basic Education Understanding a Candlestick Chart. Technical Analysis Basic Education The 5 Most Powerful Candlestick Patterns. Advanced Technical Analysis Concepts Understanding the 'Hanging Man' Candlestick Pattern.

Partner Links. Contrary to their names, they also often act as continuation patterns. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. The pattern is composed of a small real body and a long lower shadow.

Understanding Three Black Crows, What It Means, and Its Limitations Three black crows is a bearish candlestick pattern that is used to predict the reversal of a current uptrend. White Candlestick Definition A white candlestick depicts a period where the security's price has closed at a higher level than where it had opened.

Bullish Engulfing Pattern A bullish engulfing pattern is a white candlestick that closes higher than the previous day's opening after opening lower than the prior day's close. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

The Ultimate Candlestick Patterns Trading Course (For Beginners)

, time: 38:1116 Candlestick Patterns Every Trader Should Know | IG US

The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. It is a three-stick pattern: one short-bodied candle between a long red and a long green. Traditionally, the ‘star’ will have no overlap with the longer bodies, as the market gaps both on open and close Oct 30, · CANDLESTICK. Candlesticks were introduced by a Japanese rice trader, Munehisa Homma in 18 th century.; He thought that trader should consider high and low values too along with open and Close values, then he created candlestick in which body and wick of the candle represents high, low, open, close values.; He made fortune by introducing candlesticks and their analysis into his Dec 26, · A sign of lower prices on the way, the bearish engulfing pattern is made up of an upwards candle being consumed by a larger, downward candle. This candle signifies that sellers have taken over buyers and are aggressively moving prices down. This pattern is the opposite of the bullish engulfing candlestick blogger.comted Reading Time: 8 mins

No comments:

Post a Comment